Property Condition

Score the condition, quality and potential of homes based on their property photos

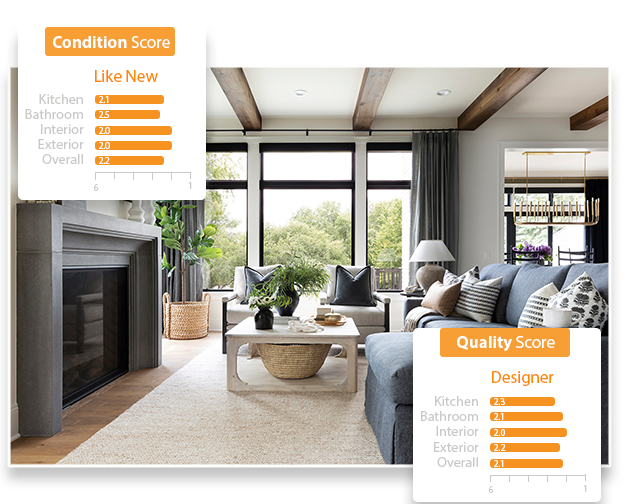

Standardized condition and quality assessments at scale

While AVMs (Automated Valuation Models) accuracy has greatly improved over time, they still feature a glaring blind spot. How can these models reliably understand a property’s quality and condition? Has a property been meticulously maintained or experienced severe wear and tear? Is a property made of builder grade materials or with high-end finishes? While these insights may be readily apparent when looking at a property, there has not been a way to efficiently provide these details to AVMs… until now. Our proprietary condition and quality scoring models allow you to apply a consistent and standardized score across every property in your model.

Photo-based condition analysis

Working closely with many of the world’s leading valuation companies, we’ve built several models to score a property.

- R1R6 model – Our original, proprietary model examines a property’s quality, condition and potential to provide an easy to consume score for valuation models

- C1C6 model – Follows Fannie Mae’s appraisal guidelines and scoring methodology, this model purely focuses on a property’s condition

- Q1Q6 model – Similarly following industry guidelines, this model focuses on how Fannie Mae determines a property’s quality

All models provide an overall property score as well as sub-property scores analyzing the kitchen, bathrooms, interior and exterior.

BENEFITS

Why should you use AI to assist property valuations?

They say a picture is worth a thousand words, yet most AVMs don’t rely on them at all. As such, most models assume each property to be in a similar condition, regardless of whether it has just been renovated or it’s been slowly falling into disrepair. Analyzing photos to digitize this information leads to better valuations, more profitable investment decisions and lower portfolio risk.

Up to 10%

more accurate property valuations

Analyze 10x

as many investment properties

Save hours

finding the perfect comparables

Based on industry standards

In addition to the Uniform Appraisal Dataset developed by Fannie Mae and Freddie Mac, we’ve partnered with real estate experts from the automated valuation, insurance and appraisal verticals to validate and improve our models.

Standardized results, granular insights

Current appraisals rely on property level scores for condition and quality. How are appraisers supposed to consistently handle homes with a renovated kitchen, but dated bathrooms? What happens for homes that are on the edge of being a C3 or a C4? Our AI allows for a standardized and consistent scoring methodology to be applied to all homes while also providing more granular details than is possible in current appraisals.

AVMs see up to an 18% decrease in mean absolute error (MAE) rates when using our automated condition and quality scores

USE CASES

Endless property condition possibilities

Improve AVM accuracy

Current AVMs neglect property condition. Enhance your model with standardize scoring across every property in your dataset.

Source better comparables

Comparables are essential part of property valuations. Layer in condition and quality data to ensure you’re working with applicable comparables.

Determine what fits your buy box

Many investors target specific properties. Instantly determine if a home is rent ready (no repairs needed) or a fix and flip candidate.

Quality control on appraisals

Appraisals require strict scoring on a property’s quality and condition. Leverage AI to ensure quality standards are being met and bias eliminated

Identify renovation opportunities

Identify not only what a property is worth, but what it’s theoretical post-renovation value could be.

“ Property photos contain many details that are impossible to find in typical property datasets. With Restb.ai, we gain access to critical insights that are crucial to accurately valuing properties.”

Hamidreza Etebarian, Co-founder and CEO – Offerland

Understand the condition of your properties at scale